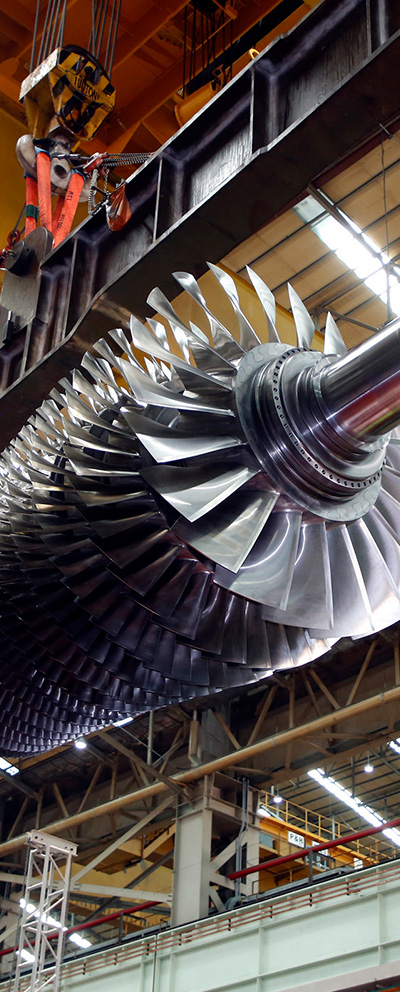

- Doosan Enerbility

- Doosan Bobcat

- Doosan Mottrol

- Doosan Fuel Cell

- Doosan Tesna

- Doosan Robotics

- Doosan Mobility Innovation

- Doosan Logistics Solutions

- Doosan H2 Innovation

- Doosan Investments

- Oricom

- Hancomm

- Doosan Magazine

- Doosan Bears

- Doosan Cuvex

- Doosan Corporation Electro-Materials

- Doosan Digital Innovation

- Doosan Corporation Retail

- Doosan Yonkang Foundation

- Doosan Art Center

- Doosan Business Research Institute

Press Release

- No. 1 in wafer tests in Korea; high growth potential due to expansion of system semiconductor market

- To be nurtured as a pillar of the business portfolio; “We will become a key company in Korea’s semiconductor ecosystem.”

The Doosan Group has entered the semiconductor business.

Doosan Corporation held a board of directors meeting on March 8 to decide to take over TESNA, the No. 1 company in semiconductor testing in Korea, by signing a stock purchase agreement (SPA) to acquire all of TESNA shares (38.7%) — including common shares, preferred shares, and BW — owned by TESNA’s largest shareholder, AI Tree Limited, for 460 billion won.

TESNA is a company specializing in testing system semiconductor products such as application processors (AP), dubbed the “brain of mobile phones,” camera image sensors (CIS), and wireless communication chips (RF). It has the highest competitiveness among companies of the same type in Korea and holds the biggest market share in wafer* tests.

*Wafer: A thin circular plate that is a semiconductor-integrated circuit substrate (chip), usually made of silicon. Ten to 10,000 chips are engraved on a wafer, and the process of selecting good/defective wafers is important as it affects the precision of semiconductors.

The semiconductor industry is divided into memory semiconductors that store data and system semiconductors manufactured for information processing such as sensing, operation, and control without data storage. The ecosystem of the system semiconductor industry consists of fabless companies with only design and development capabilities, foundry companies dedicated to manufacturing on consignment, and outsourced semiconductor assembly and test (OSAT) companies that assemble, test, and package processed wafers.

As an OSAT company, TESNA has Samsung Electronics and SK Hynix as its main customers in Korea. It possesses high market and growth potential, presumably due to the recent expansion of the foundry market, increased investment in Korea's system semiconductor sector, and increased OSAT outsourcing. The earnings growth trend is also clear, with sales and operating profit increasing 56.6% and 76.8%, respectively, to 207.5 billion won and 54 billion won, respectively (separate basis) last year compared to 2020.

With this acquisition as a starting point, Doosan plans to foster the semiconductor business as a pillar of its business portfolio along with the existing energy (power generation) and industrial machinery sectors. To support the plan, it presented a goal of growing into the key company of Korea’s semiconductor ecosystem through the gradual expansion of its business domain as a semiconductor OSAT company by strengthening TESNA’s competitiveness as the no. 1 semiconductor testing company in Korea through active investment and by securing cutting-edge packaging technologies in the mid- to long-term.

Believing that demand for semiconductors will continue to grow in line with the global industry megatrend expanding to AI, AR/VR, big data, 5G, and electric vehicles/autonomous driving, Doosan has continuously sought opportunities to enter the semiconductor business.

“The semiconductor sector is expected to continue to grow rapidly across all industries in the future. Doosan intends to grow TESNA into Korea’s leading semiconductor OSAT company through active investment,” a Doosan official said.